- Let's learn the path to financial freedom

- Posts

- Crash Course on Crypto, Week 4: From Regression Channels to Common Pullbacks

Crash Course on Crypto, Week 4: From Regression Channels to Common Pullbacks

Why January's tax tricks, humanoid robots, and Elon’s blockchain dreams are setting the stage for a wild ride.

Good Afternoon, and welcome back to ToTheUnknown,

The newsletter that’s like a big stake with eggs, and veggies.

(Always good and great for your mental, and overall health)

Today’s manu is (once again) full of notes. And these are not ordinary notes (I’m writing this so you’d think they are special, but in reallity you’re the one who can say if they were helpful or total bullish*t).

This into was short, but who need long intros, the nootes are 100x better, right!?

Heres the menu:

Buckle up, because today’s post is lean, mean, and 100% bullsht-free.* Let’s dive in.

⚒️ What I’ve been up to

I haven’t done much (I think 👀).

I’ve been learning, snatching some templates, and growing my social media accounts like they’re rare Pokémon, and tried to once again film myself spoiler alert: it was painful.(the story goes a bit further than that).

So here’s the scene: woke up at 4am to go for a run and film.

The plan?

Run, hit the park, and nail some content on camera.

Went to a nearby park to film, but I forgot, how awkward I am infront of the camera😆.

It was painful.

But here’s where things got messy.

I got to the park, camera ready… and I froze.

Like, legit statue mode.

Usually, I can talk like I’m auditioning for a TED Talk—words just flow, no stopping me.

But in front of that tiny lens?

I was as blank as someone forgetting their lines in a school play. (Imagine that awkward moment when you say, “Hi, my name is…” and your brain goes static noise).

And if that wasn’t enough, it was snowing/raining, the lighting was bad (shoutout to park lamps for being the worst lighting crew ever. To be fair, in that darkness I can’t expect anything), and my hands were numb.

I did get a few clips, but they’re… rough.

Like, “your mom’s first attempt at TikTok” rough.

But honestly, I need to get one out there, no matter the quallity really (the audio has to be great at least).

So I came up with Plan B: record a voice memo at home, practice, and THEN film myself somewhere nicer (and warmer).

But wait—yesterday wasn’t all awkward vlogging attempts.

It was my aunt’s husband’s birthday, and I had a blast.

Sauna sessions, great conversations, and (I can’t believe it either) ate a little piece of cake—oh, the cake.

Let me tell you about this cake.

It was a cake coveres in cacao and tasted immaculate (not my usual vibe, I mean that i eat that sort of a cake), and the other?

A masterpiece my mom baked with oats, no sugar, and zero guilt.

Imagine eating cake that tastes amazing and feels like a high-five for your health. I mean, it just made me feel mentally very very great, and come on, how can you not smile after that?

By the way, if you want some of those guilt-free recipes, hit reply on this email, and I’ll sort you out with something.

Fun fact: I’m actually working on a healthy recipe book with my mom.

We’ve been brainstorming ways to spend more time together, and what’s better than creating something delicious AND healthy (and I mean really healthy resipies, because I’m obsessed with health, and life/health optimisation).

How am I feeling?

Here’s today’s vibe:

❤️❤️❤️❤️❤️ / ❤️❤️❤️❤️❤️

😄

The hearts are my mood/how happy and I mentaly feel.

The emoji is to also give a perspective of my feelings and being.

Now the week’s reflection

Monday

Normal day, not bad (no day is bad on my opinion. I’d say, that you should take the maximum out of every day), and not the best. After a morning workout I read “Fooled by Randomness” (this book took a bit too long to finish, but got to it at the end). Meditated, and as that day was a school Olympiad in physics (these are great, because they save me a TON of time). I understood, wait for it…… basically nothing. And after that went home and wrote the newsletter.

What was the best part about that day?

I got extra time to wrk on MY stuff, while others were in school.

What made you feel awful that day?

The newsletter took forever to write.

Tuesday

Great day on my opinion. Prepped slides for a school project I made for my grandma (she loved it, btw). As you guessed… I don’t remember anything that happened in school (I don’t really remember any day in school, happens what happens. Don’t really care. In the end, it’s not my priority). I made a draft for my project and learnt about media a bit. School took a big part out of my schedule, but I liked that I managed to do almost everything I planned to do that day. As that day was my dad’s birthday (he was on a trip in the Azores with my sister and his wife), I called him and we talked for quite a while. Maybe a bit too long that I didn’t have much time to read, but that was not as important.

What was the best part about that day?

Finally finished the project and got rid of some of the duties.

What made you feel awful that day?

School being… school. Taking valuable time.

Wednesday

Happy with the day. Presented my project, and got rid of the 2 lessons (the best thing school has done in a long time, and the fact that new lessons are not replacing it is amazing). Wrote a newsletter post, got some time to go over learning matterial. Went over some emails in school whitch was great.

What was the best part about that day?

Got rid of 2 lessons.

What made you feel awful that day?

School, as always.

Thursday

Was also a great day. Started reading a new book called “Skin in The Game” by (once again) Nassim N. Taleb. Read some emails in school. School was very depressing. I’m not depressed or anything, I mean I didn’t feel great in school. At some point my head started hurting also. At least at home I made the best chicken I have ever eaten, better than yours gordon.

What was the best part about that day?

The morning and the chicken.

What made you feel awful that day?

School.

Friday

Very good day. Learnt some chemestry at school, and overall school went by very fast, and I’m supper happy it did. At home learnt a bit (when I learn it’s not because of school), and watched a PGA video (which no longer exists, but don’t worry—I took notes). I’ll try to explain it as well as Nicolas Cole.

What was the best part about that day?

School went by supper fast.

What made you feel awful that day?

Didn’t go to bed as early as I would have wanted.

Saturday

Amazingly, amazing day. Woke up at 4am, but my self ready and went outside for a run, started filming myself (you already know how that went). Really, loved the entire day, and today. Read my book after the run, read my emails, learnt (as always), and celebrated my aunts husbands birthday (he got 45, and I loved the birthday, almost every fun person was there to create a great mood), and went on a sauna spree. Everything was amazing. But we started driving at 00:00 and got home at 02:27am, almost when I would have woken up. We didn’t stay there for the night, which would’ve been better, but hey, still was a great day.

What was the best part about that day?

Everything.

What made you feel awful that day?

Didn’t stay there for the night. It would’ve been beneficial for my time.

Sunday

Not as great day as yesterday, but loved it still. Woke up late (9 or 10 a.m.), and wow, I felt like I’d missed half my life (it was BAD). No wonder late risers always feel like they’re behind. Did some reading, and went on a walk (also a must-do-daily-for-the-year).

What was the best part about that day?

Walking and just reading, and doing my stuff.

What made you feel awful that day?

Waking up so late.

Okei, enough of me, time for the notes:

🤑 Crash Course on Crypto: From Regression Channels to Common Pullbacks

📈 Linear Regression Channel

I’ll get straight to point here, no time to waste:

When something grows like crazy (like technologies with network effects. Think 1, 10, 100, 1,000 instead of 1, 2, 3, 4), you can’t just look at it on a straight, linear scale.

It’s like trying to fit an elephant into a hamster cage—it’s not going to work.

This is why assets that have exponential growth should be viewed on a logarithmic scale (1,10,100,1000, etc) rather than a linear scale (1,2,3,4,5, etc) when looking at long term.

This is super useful when analyzing technologies with network effects—like Apple or Bitcoin.

What are network effects?

Picture this: if you were the only person with a phone, it’d be useless. But every new person who gets one makes your phone more valuable. That’s a network effect. The more people join, the more powerful the network becomes.

Each of these technologies with network effects (as long as thoose network effects don’t break) follow a similar growth path along an exponential chart.

The chance of it breaking is very low, when the network is well known and established.

Here is an example of Apple following this channel since 2002:

These are old pictures, sorry

Here is Bitcoin on a log scale with a regression channel that has lines projecting the top and bottom of Bitcoin this cycle:

Also, an old picture

In the first 2 cycles, Bitcoin reached 2 standard deviations overbought (the top blue line) from the trendline (the gray line). In the last cycle, Bitcoin reached 1 standard deviation overbought from the trendline.

If Bitcoin reaches 1 standard deviation overbought from the trendline at the projected top of this cycle, that would give us a $BTC price of $1.2 million.

But this bear market was also the first time Bitcoin went below 1 standard deviation oversold (the 1st purple line), so maybe BTC is slowing down and can only reach the trend line.

That would give $BTC a price of $469k.

And even if Bitcoin remained 1 standard deviation oversold for the entire cycle, it would still give us a price of $188k.

So let’s go with a range of $188k - $1.2 million. That’s a 2.7x - 17x from the top of the last cycle.

(remember these are notes, and not up-to-date. I wrote them a while ago. Now there are better predictions. The predictions are not made by me, lets get that straight)

But let’s remember that < 1% of the world's money is in crypto and < 1% of the world is onchain using crypto.

If crypto continues to gain adoption, the potential is absolutely massive.

Remember, these are only projections for less than 2 years from now!

Imagine if we did these for 5 - 10 years from now. 🤯

⚖️ Logarithmic Scale

(Yes, I know these topics overlap a little, but these are my notes. I write it here like I have it written down in my notebook, almost.)

Ever heard someone say, "That’s a bubble—it’s going to burst!"? Happens all the time, especially with technologies that grow so fast they leave traditional investors scratching their heads.

Take Amazon as an example.

If you look at Amazon’s stock on a linear scale since 1997, it seems like it’s been in bubble territory forever

Here is a chart of Amazon on a linear scale since 1997. Did the bubble just pop?

Old picture, I’m just teaching you.

Every spike feels like the end is near.

But here’s the trick: put the same chart on a logarithmic scale, and suddenly, those bubbles don’t seem so scary. They just look like tiny speed bumps on a massive, 25-year secular bull run.

Here is a chart of Amazon on a logarithmic scale since 1997. This “bubble” now looks irrelevant.

The purple, blue, and grey lines are a simple logarithmic regression channel, which is essentially mapping exponential adoption or exponential growth in price based on standard deviations of price.

Why?

Because Amazon isn’t just growing—its growth is exponential. And when you’re dealing with exponential adoption or value creation (thanks to network effects), the game changes entirely.

The same applies to Bitcoin and other tech with massive adoption curves.

What’s a Logarithmic Regression Channel?

Picture a roller coaster ride, but instead of chaotic ups and downs, you have neat, predictable lanes. That’s what a logarithmic regression channel does.

It maps exponential growth using standard deviations from the mean price:

Middle line (grey): The long-term trend line.

Outer lines (purple & blue): The boundaries where prices tend to stretch (like elastic) before snapping back.

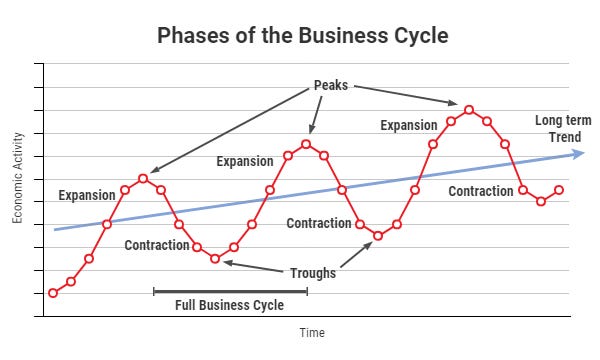

📉 The Business Cycle

Now, let’s talk about the business cycle, aka the puppet master pulling the strings behind all this.

Who’s pulling the strings? Central banks and the Federal Reserve.

How? use these 2 levers to stimulate or slow down the economy when needed:

1/ Interest rates (how expensive it is to borrow money).

2/ Money supply (how much cash is floating around in the economy).

When interest rates are low and money supply is increasing, the economy booms. Companies innovate, stocks skyrocket, and tech with network effects (like Bitcoin or Amazon) grows exponentially (an expanding economy).

But when interest rates rise and money supply tightens, the opposite happens. Growth slows, valuations drop, and everyone panics (a contracting economy).

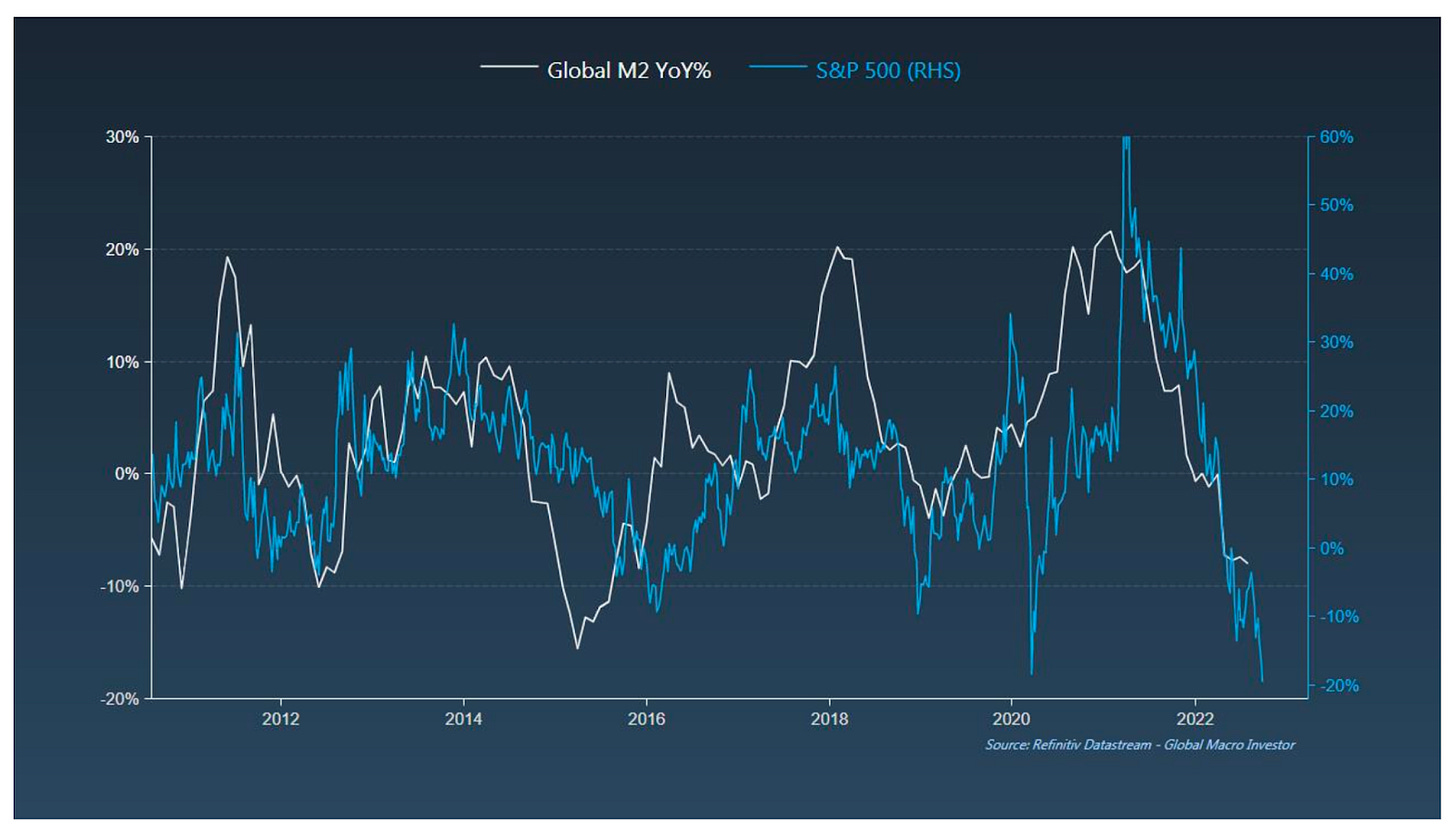

If you track the global money supply (aka M2) you can see these cycles clearly.

In the chart below you can see the year-over-year % change in global money supply (white line) and its cycles versus the year-over-year % change in the price of the S&P 500 (blue line).

The chart doesn’t lie:

The global money supply (M2) has a clear cycle.

It matches the performance of the S&P 500 almost perfectly.

When money is flowing (M2 increases), markets rally. When money dries up, markets tighten. Technology companies feel this shift the most because they thrive on growth and cheap capital.

📉 The Pullback Playbook: Common Pullbacks

Ever notice how the crypto market (and sometimes stocks) seems to hit a speed bump at specific times of the year?

It’s not just your imagination—there’s a method to this madness, and it’s tied to human behavior, taxes, and yes, even vacations.

Let’s break it down month by month so you can stay ahead of the game:

January Pullback

Both 2016 and 2020 were very good years foor crypto investors, so people naturally want to take profits (which you should do either way throuout the entire bull cycle, by DCA)

Here’s the scoop:

If investors sold on December 31st instead of January 1st, they would need to pay their taxes on their capital gains by March of that year (in the U.S.).

If they wait 1 day and sell on January 1st, they don’t need to pay taxes until the following March.

This means investors are essentially taking out a free, 1-year “loan” from Uncle Sam (the government), reinvesting that money, and delaying their tax bill.

Clever, right?

So, when you see a dip in January, it’s often just people taking profits after ringing in the New Year.

March Pullback

By March, it’s time to pay the piper—or, in this case, the taxman.

Many investors who sold in January of the previous year need to cough up cash to pay their tax bill.

And guess what?

To get that cash, they often sell more assets, causing a pullback.

Even though this pattern is mainly driven by U.S. investors, it has a global ripple effect.

Why?

Because the U.S. is a powerhouse in crypto and tech:

U.S. residents alone own 0.19% of all Bitcoin in circulation (this could be wrong but I can’t be great at everything).

That stat might sound tiny, but this is only residents. This doesn’t count the companies that HODL $BTC (like $TSLA, $MSTR, Blackrock, and Fidelity ETF’s)

One pullback that does happen more often than not, is in may.

“Sell in May and go away”– May Pullbacks

Ah, May. The month when the rich and powerful pack their bags and head for the Hamptons, Maldives, or wherever their private jets take them.

Here’s what happens:

Wealthy fund managers and bankers—the people who control the most capital—take their summer vacations.

As they soak up the sun, markets tend to chill too. Capital flows slow down, and prices often pull back.

And fun fact: it’s not just a crypto thing. Even in traditional markets, the U.S. stock market has historically made most of its gains between November and April, with May to October being a snooze-fest.

Check out their averages below versus May to October.

The saying “Sell in May and go away” comes from this very pattern - clearly it’s a winning strategy historically.

Q4: The Bitcoin Boom

Here’s some good news: Q4 is historically Bitcoin’s MVP season.

Even during bear markets, Bitcoin tends to show at least some gains in the last quarter of the year.

How to Use This Info

Now that you know the “why” behind these pullbacks, you can plan ahead:

January: If you’re planning to take profits, think about timing (and maybe delay your sale to January to push that tax bill).

March: Be cautious—selling pressure might increase as taxes are due.

May: Don’t freak out if the market cools off. Remember, the rich are just sipping cocktails on a yacht somewhere.

Q4: This is when the magic tends to happen, so keep your eyes on the prize.

But don’t trade your entire portfolio. If you haven’t yet read Crypto Crash Course: Week 2 – Notes Full of Nuggets, where I help you diversify your portfolio, you should head to it right now!!

Ok, that’s all for this crypto crash course.

I’ll drop some last notes I have in my notebook soon. Maybe I’ll also start taking notes on my computer, but honestly, I still rather write my notes into a notebook, because you actually learn by doing it (at least you’d learn a lot more than tiping it on a computer)

How do I know? It’s because I’m a wirdo and took a course on how to learn OPTIMALLY.

🚨News you need to hear:

🤖 AI16Z’s Humanoid Robot: Is This the Future or a Fancy Gimmick?

Remember when 2021 was all about the Metaverse?

Yeah, we were supposed to be living in VR by now.

But in 2025, it’s…humanoid robots?

The folks behind Eliza, the AI framework powering ai16z’s Marc AIndreesen, just announced they’re planning to launch a humanoid robot that’s part butler, part bodyguard, and part…cigar cutter?

BREAKING: @elizawakesup IN COLLABORATION WITH @eliza_studios (@ai16zdao) @OldWorldLabs@AI__Combinator@RyzeLabs ANNOUNCES PRESALE FOR ADVANCED HUMANOID ROBOT

elizawakesup.ai/robotics— ai16z NEWS (@ai16zNEWS)

3:25 PM • Jan 15, 2025

Now, let’s make it very clear: it’s NOT a sex robot. Ok? Good.

Specs:

Height: 180 cm (roughly the size of an NBA point guard).

Weight: 47 kg (lighter than your average fridge).

Battery Life: 8+ hours (so, it’ll last longer than most iPhones).

Speed: Can run an 8-minute mile or sprint 5 meters per second. (Faster than you when you're late for the bus.)

Features:

Conversation Pro: It uses an AI LLM to chat with you like a bestie, therapist, or customer service rep—all rolled into one.

Emotional Intelligence: Realistic human-like expressions that can smile, frown, or judge your bad jokes.

Physical Skills: It can serve drinks, cut cigars, or help with chores (if only it could do homework, am I right?).

…ok, I take it back.

Someone is definitely going to try and f*ck this thing.

🤔 But Will This Thing Even Happen?

Let’s not forget the golden rule of futuristic products: hardware is hard.

Sure, the specs sound cool, but building a humanoid robot is a moonshot project.

It takes time, mountains of cash, and a bit of luck. For all we know, this could just be an epic marketing stunt to create buzz.

Think about it: why would anyone pay $420k for a cigar-cutting robot when you could buy:

A Tesla Optimus Robot (launching soon) for $30k.

A Boston Dynamics robot dog for $75k (bonus: it doesn’t complain).

Or hire a real human butler for years without burning through $420k.

What This Really Means

Here’s the bigger picture: this announcement might not be about the robot itself. It’s a sign we’re entering the mania phase of the market.

You know, that wild time when people spend ridiculous amounts of money on shiny, unproven things (hello, NFT boom of 2021).

If nothing else, this robot is a great reminder that:

1/ Builders dream big (and we love that).

2/ We should all take a breath and wait to see what actually comes to life.

Pro tip: If you’re hyped, learn to meditate. This robot might take years to hit shelves—if it even gets there.

🐕 Musk & DOGE Blockchain: Budget Cuts or Meme Moves?

Elon Musk is at it again—this time, he’s diving into blockchain tech for government cost-cutting. According to Bloomberg, Musk is working with the Department of Government Efficiency (Trump’s newest project. Hehe DOGE) to explore how blockchain could make federal systems more efficient.

Here’s the thing:

Musk wants to use blockchain to protect sensitive government data and track money flows.

Trump’s camp has already used the Solana blockchain to mint memecoins like TRUMP and MELANIA.

It’s unclear which blockchains are in talks, but we know Musk loves DOGE. Could this mean a government-backed DOGE coin for transactions? (Imagine paying taxes with DOGE. Wild.)

While details are fuzzy, one thing is clear: if Musk is involved, the headlines (and memes) will keep rolling in.

TL;DR: What You Should Know

AI16Z’s humanoid robot is shiny, pricey, and ambitious—but don’t expect it in your living room anytime soon.

Musk is blockchain-curious and wants to use it for government cost-cutting. Could DOGE finally hit the big leagues?

The mania phase of the bull run is heating up. Get ready for wild products, wild headlines, and maybe a few regrets (but hey, that’s half the fun).

That’s a wrap, folks!

Either way, I hope you’re leaving with some fresh insights, a chuckle or two, and maybe a side-eye at your toaster for not cutting cigars.

As I have been bulking for some time I have gained a bit of fat (still can see my abs well, and looking great), but I don’t remember where, but someone sayd that it’s not a good idea to have that fat around for long (I’m not doing the justice by describing it 😅).

Oh, I think I remember, it was Mike Isretale. I’ll look the video up, it was a while ago, but as I don’t watch many YT videos, I have it close in my watch history: My 5 Biggest Nutrition Mistakes (So You Can Avoid Them!). Around 2min mark.

Let’s get this staright, I don’t go for food advice to him. This just seemed interesting what he sayd and I did some research and it seems to be like that.

I also heard a great podcast today (Monday, and yes it was First Things Thurst) that made me question some of my food choises (and I don’t go of of one saying that this and that are bad or live changing).

I mean, I have heard some of the things somewhere else, and they go hand in hand with my knowledge, and research. It was called: Simple Hacks to Transform Your Life in 30 Days (Biohacking Guide) | Dave Asprey.

Enough of recomendations, this was supposed to be a sign off, but turned into a brain dump.

I guess, that happens when you have yourself in check😁.

I wanted to include one more topic of global liquidity (to explain why the crypto markets were down recently, but it would have been too much for this newsletter).

Unfortunately, no room to make a shout out🥲🫠

Catch you Wednesday!

Reply