- Let's learn the path to financial freedom

- Posts

- Crash Course on Crypto: From Tokenomics to Bitcoin Dominance

Crash Course on Crypto: From Tokenomics to Bitcoin Dominance

It finally came!!!

Good Evening, and welcome back to ToTheUnknown,

The newsletter that’s like a treasure map—you never know what you’ll find, but it’s always worth the adventure.

Let’s not waste any valuable time, and get straight to the menu:

⚒️ What I’ve been up to

As you know, Trump is set to take office tomorrow (today). Love him or hate him, this is will stir up the markets.

Personally, I’m excited —whether it’s due to his policies or just the buzz he creates, I foresee the markets gearing up for some action. I’m going of off what he has done in the time, that he hasn’t been in office yet.

Stick around till the news section for a little nugget on why this could be huge.

How am I feeling?

Entrepreneurship is no joke (as I’ll be heading head on to it), so I’ve decided to start including a mood check-in with each newsletter. Great way to see the ups and downs of this journey, as well as a good moment for me too pause and reflect.

Let’s keep it simple and emoji-based, because why not?

Here’s today’s vibe:

❤️❤️❤️❤️❤️ / ❤️❤️❤️❤️❤️

🤓

I’ll be reflecting a bit more on my weeks from now on, I think it’ll be beneficial for me.

Reflecting on my mood not only gives me a chance to pause but also helps you peek behind the curtain of this journey.

So, let’s roll with it.

Oh, and big news—I’m aiming to get my first YouTube video out by the end of this month or early next month.

Stay tuned!

I’ll give you my weekly reflection now and if you don’t want to read it, you can skip to the Crash Course Part, thats where the crypto notes start.

Weekly Reflection

This week had its ups and downs, but overall, I’m feeling good. Here’s a quick breakdown of each day:

Monday:

A productive, and a great day! I set up and customized my YouTube channel page and explored new tools, that I’ll be useing for my agency. School felt like a time sink—waiting for the bus for 40 minutes didn’t help. Still, I have to start doing more of my work, meditatins, and reading emails in school, rather than waste my time.

Best part: Customizing my YouTube channel and discovering new tools.

Worst part: Wasting time at school.

What was the best part about that day?

Customizing my YouTube channel and discovering new tools. One standout tool that I discovered was similarweb, a tool for analyzing competitors’ workflows. It shows you what tools the brand are useing.

What made you feel awful that day?

For sure school, wasteing my damn time, not necessarily learning anything important.

Tuesday:

I’d say this day wasn’t so successful, because I didn’t get to do the stuff I would have liked. My sister’s birthday took center stage, which was held quite late, and I got home late (for me late OK, at 21.00). I even cooked a gift for my dad (yes, literally cooked—proving I’m a chef extraordinaire). That was where most of the time went. I can’t be that mad about it, because I chose to do it. I would have gotten away with doing nothing, but I’m too generus and too nice of a person, maybe soometimes too nice, but hey, don’t care. If it starts to comeing into my business, I’ll cut the presents back. I got litterally nothing done that day, other than meditate, which is a must-do-evey-day-for-the-year. I wrote out my ideas that day for a YT video, but didn’t film it. I struggled to start filming. Talking to a camera feels awkward, but I know pushing through this discomfort is key.

What was the best part about that day?

The best part was when I tried to film myself, but couldn’t. You may be asking, how’d that be a great part f the day? It was because I was trying and the fact that I even had the thought to do it was a win-win for me. I wrote down some notes, of what I’d talk about on my first YT video—it’s a step forward.

What made you feel aful that day?

Not getting much done and going to bed late.

Wednesday

Not my finest day. I focused on tasks that didn’t move the needle much. I’m mad, because I haven’t been working on the stuff that matters the most. My mind shifted a little, and I didn’t get as much done as I’d liked to. Wrote a newsletter post, that took quite a bit out of time out of my learning. Haven’t even gone running, because of school.

What was the best part about that day?

I took some time in the morning to read a book. Which is called “Fooled By Randomness” (review and recomendations gomeing soon).

What made you feel aful that day?

Missing my run and juggling school projects.

Thursday

This day was a mixed bag… (what is happening, why are my days not successful!? I should really define for myself, what a successful day looks like: Successful day for me is when I can go t the gym in the morning, go too bed on time, read a book before going to bed for 1-2h, mediate (which is a no brainer), I can work on what I like and what moves the needle, and go for a walk (relax). I don’t like when my mind is crowded with noise that isn’t needed, that’s why I don’t watch TV, and news. I stay up to date on the news that I find interesting). Where were we, oh… at home I attended a seminar called Online Businesses CEO Coffee Break (which turned into a sales pitch, classic). Later, I dashed to the theater with my grandmother, which was nice but left me with little time for anything else. Went to bed late, not happy 😠

What was the best part about that day?

Gaining insights from the seminar (before the sales pitch). Nowadays everyones content is like a big sales funnel (basically the exact point of a personal brand), they always start selling at the end, (this is a bad example): “Yappa, yappa, yappa, this is such a great course, buy it now”. Many dummies don't understand it, but if you’ve been in this space for quite some time (for 3-2years), you start to notice these things everywhere. Even the very well done “sales funnels” that are hard to see at first.

What made you feel aful that day?

Getting home late and missing my reading time.

Friday

That day was quite successful. I didn’t get much time to do the stuff I value, but… I got some small little stuff done, that free up my time in the future, which is why I’d say it was an alright day. At home I wrote a post on X, which took a long time, but gives a method, that I stared useing more for myself, to help me get the stuff that matters done.

What was the best part about that day?

Clearing up small tasks.

What made you feel aful that day?

Doing things I didn’t enjoy.

Saturday

This day was alright, considering that a birthday party took almost 5h out of my working/learning time. I got too read my book, did some learning, and got to read some of my emails.

What was the best part about that day?

Connecting with family and friends while staying productive.

What made you feel aful that day?

The Birthday taking up so much time (it wasn’t only the birthday, I went to the grocery store with my mother, which took some time off. Should really just buy food online.)

Sunday

Today is for sure the best from them all. Today was as free as I would like every day to be like. I didn’t go to the gym, but I read the book. At one point I read some emails, and then spent learning about the personal brand and posting. Then meditated, and thought I should clean my room even more (I clean it almost every week). This was a great decision, that I should have done on the first day of the year, but thought my room was clean (spoiler, it was, but I made it even more cleaner, so it would feel nicer and better to do some deep work in. Litteraly doing some deep writing right now. After the cleaning/tidying up, I made some fast-food for myself. Don’t freek out, I mean fast-food, like puting some veggies and chicken liver in the oven and at the same time going for a walk. Walked for about 30min and ate. After that I started writing this post for today.

Best part: Deep cleaning my room and feeling more organized.

Worst part: Honestly, nothing. It was a great day.

What was the best part about that day?

I cleaned my room, and feel a lot better now, feel more free. But there are still some stuff I need to move, but all-in-all a great decision.

What made you feel aful that day?

Honestly, nothing. It was a great day. But no day is perfect… YET.

That’s the end of my weeks reflection. Now to the crash course, there’s no time to waste, strainght into the next topic:

🤑 Crash Course on Crypto: From Tokenomics to Bitcoin Dominance

Tokenomics: It’s Like Supply and Demand Had a Baby

The price of any token boils down to one thing: buyers vs. sellers. If more people want to buy than sell, prices go up. If everyone panic-sells faster than I run from chores, prices drop.

Simple, right?

But tokenomics isn’t just a fancy word—it’s your cheat code to understanding why tokens move the way they do.

When analysing tokenomics, your goal in the end is too figure out who and how many are buying and selling.

1/ Circulating Supply vs. Total Supply

Imagine you’re at a pizza party.

The pizza on the table (circulating supply) is what’s available for you and your hungry friends. But the chef in the kitchen is secretly baking more pizzas (total supply).

If he dumps a ton of fresh pies onto the table, each slice becomes less valuable.

That’s what happens when there’s a large gap between circulating and total supply.

Where to check this: CoinMarketCap or CoinGecko—they’re like Yelp but for crypto stats.

A large discrepency between circulating and total supply could potentially dilute the tokens value in the future.

2/ Token Unlocks

Sometimes tokens are locked up, like gifts you can’t open until Christmas.

But when those tokens get “unlocked,” everyone rushes to sell, and prices can crash faster than your WiFi during a Zoom call. Token unlocks can significantly impact a tokens price (price going down).

Pro tip: Use tools like Token Unlocks to track these events and avoid surprises.

Token Unlocks can be a useful resource to track when these unlocks occur, helping you anticipate potential market fluctuations.

3/ Issuance Plan

Think of this like printing money. If a project keeps “printing” tokens, it’s bad news for current holders because the value of their tokens gets diluted.

Look for projects with a solid issuance plan—one that doesn’t inflate like a balloon at a kid’s birthday party. And always check if their policies are set in stone or might change later.

4/ Demand: The Key to Staying Relevant

Tokens need real reasons to exist. If their only purpose is to make speculators rich, that’s not a good sign. The more reason the better!

Instead, ask yourself:

What’s this token actually useful for?

Will it still be relevant in the next cycle?

Is there a new, exciting narrative forming?

What applications will we use or need to use?

Think what’ll happen in the next cycle.

Spoiler: If it’s just about hype, run.

Bitcoin Dominance

When $BTC Dominance rises, it’s time to pay attention.

It means a bull market is comeing.

Bitcoin dominance = Bitcoins market capitalisation as a % of the total market capitalisation oof all other cryptocurrencies combined.

Basically: Bitcoin dominance measures Bitcoin’s share of the entire crypto market. Think of it as Bitcoin flexing its muscles and reminding the altcoins who’s boss.

Long-term, Bitcoin dominance is expected to trend downward as the crypto space grows and matures.

But in the short term?

Keep an eye on it—it’s like a weathervane for market trends.

Bullish Onchain $BTC Indicators

1/ Total supply of $BTC held by long-term

This metric is a strong indicator of price appreciation in the future.

If long-term Bitcoin holders are stacking sats and not selling, it’s usually a sign that prices will go up. But when this metric dips, it’s a red flag—prices might be peaking.

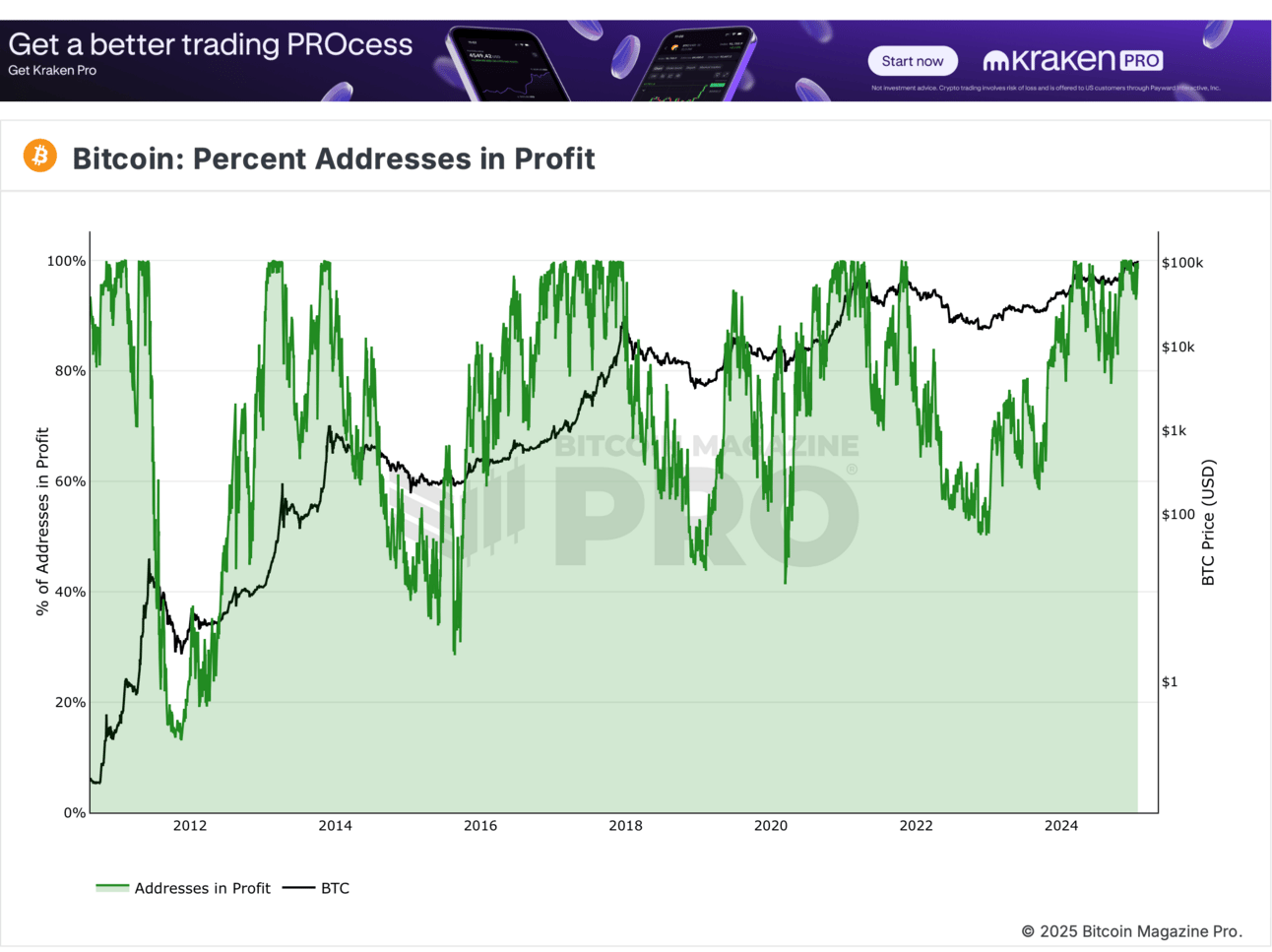

2/ The % of Bitcoin adresses in profit

If the number of profitable adresses drops below 50% (the green section), this typically marks the bottom of a bear market.

When the indicator hits the red (above 92%), it generally suggests the peak of a bull market.

Sorry, I didn’t find the chart I was referring to, so no red nor green parts to make the reading easier.

What’s a UTXO? (And Why Should You Care?)

UTXO stands for Unspent Transaction Output.

Sounds fancy, right?

Let me break it down:

Imagine you pay for lunch with a $20 bill, but the meal costs $15. You get $5 back—that’s your UTXO.

In crypto, it’s a way of tracking what’s left over after a transaction.

If the price of Bitcoin has gone up since the UTXO was created, it’s “in profit.” If the price has dropped, it’s “in loss.”

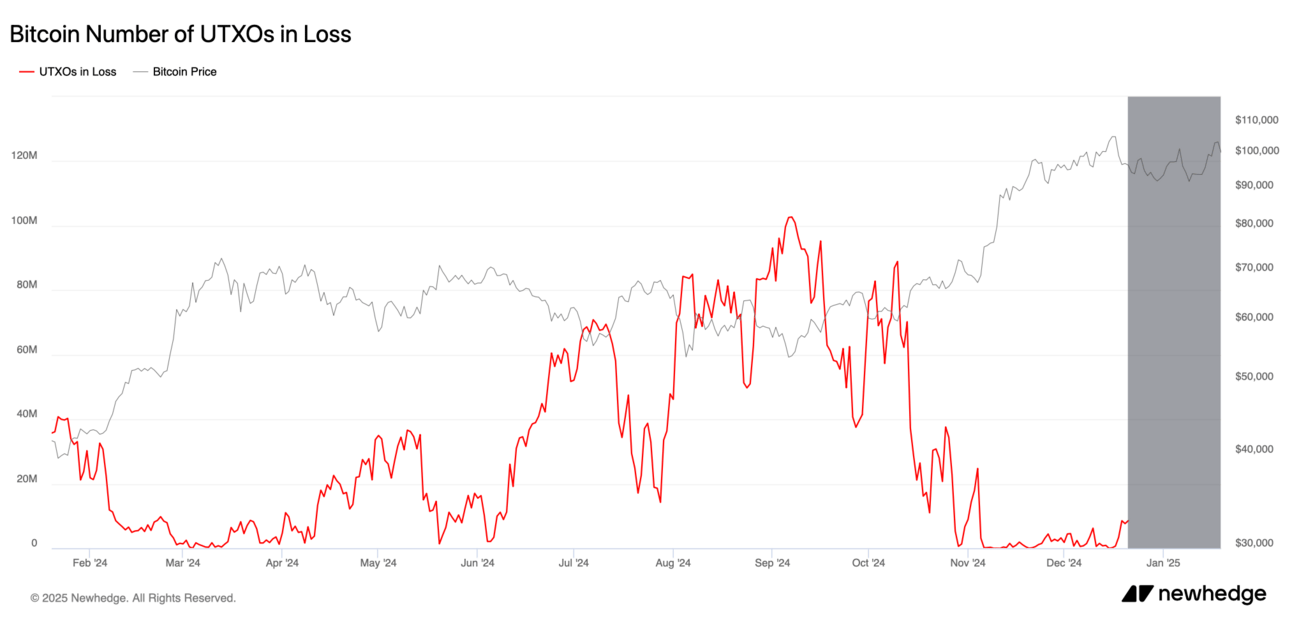

1/ The number of current UTXOs that are in profit loss.

A UTXO is in profit (loss) if the current price is higher (lower) than the price at the time the UTXO was created.

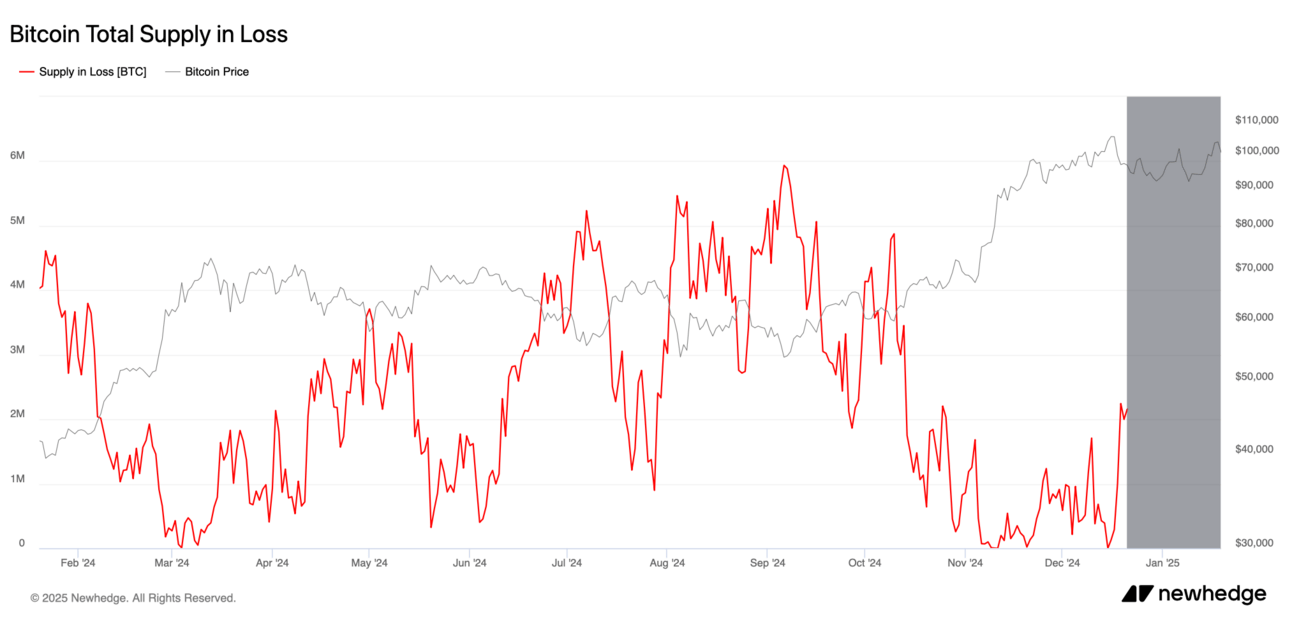

2/ The current supply of $BTC that is in profit loss.

A $BTC is in profit (loss) if the current price is higher (lower) that the price at the time of the $BTC last moved.

3/ The unrealised profit/loss oof the current $BTC supply.

The profit (loss) of a $BTC is calculated by taking the diffence between the current price and the price at the time $BTC last moved. (I’m tired of searching for the charts, I had them somewhere, but lost them. I can’t be bothered)

Why Bitcoin Cycles Matter

Crypto’s infamous 4-year cycles often get blamed on Bitcoin halvings.

A halving is when Bitcoin’s “supply faucet” gets tightened, cutting new Bitcoin issuance in half.

This supply shock tends to act as a catalyst for bull runs.

This supply cut appears to be a catalyst for each cycle. Below is a simple chart showing the price cycles of Bitcoin with a blue line representing each Bitcoin Halving:

Here’s the TL;DR: Every four years, Bitcoin gets harder to mine, supply tightens, and prices often explode. It’s like your favorite limited-edition sneakers—when supply is low, demand goes crazy.

Here is another way to look at these cycles of Bitcoin with a green line signifying the tops and a red line signifying the bottoms of each cycle:

YOY- Year Over Year

The chart of YOY change in global liquidity (the creation and destruction of new money)

Other Indicators to Watch

RBSP (Relative Bitcoin Supply in Profit):

Above 95% = market tops.

Below 50% = market bottoms.

NUPL (Net Unrealized Profit/Loss):

Helps measure whether the market is in greed (bull market) or fear (bear market).

🎁 $TRUMP Memecoin Takes Off … and Then Crashes Hard 🚨

You know crypto is crazy when Donald Trump (yes, that Donald Trump) launches a memecoin—and it skyrockets to a whopping $14.9 billion market cap, putting it in the top 20 cryptocurrencies. That’s a 1000x gain faster than you can say, “You’re fired.”

But wait… it gets juicier.

Enter MELANIA.

Melania Trump (First Lady, crypto disruptor, and apparently memecoin entrepreneur) launched her own memecoin called MELANIA right after.

The result? Chaos. Within minutes of MELANIA hitting the market, the value of $TRUMP tanked by 40% as traders dumped their $TRUMP bags to pile into $MELANIA.

Here’s the tea:

Coinbase exec Conor Grogan spilled that $MELANIA was funded by a wallet connected to a site called Pump.fun (yes, that’s an actual name).

Oh, and Donald himself? He sold $500 million worth of $TRUMP tokens before the crash, leaving traders holding bags bigger than Santa’s sleigh.

To top it off, 85% of $TRUMP tokens are still controlled by the team. Translation: This is like playing Monopoly, but Trump owns all the hotels and you’re stuck paying rent.

💡 Lesson of the Day: Memecoins are fun, but don’t go betting your life savings unless you’re okay with ending up as the punchline of someone else’s meme.

😮💨 SAB 121: The Rule That Made Banks Hate Crypto

Alright, let’s talk about SAB 121—the accounting rule that’s been making crypto feel like the kid who gets picked last for dodgeball.

…cool.

What the hell is SAB 121?

Here’s the deal:

SAB 121, dropped by Gary Gensler’s SEC (please, hold your boos…boo! hiss!), forces financial institutions that hold crypto for customers to classify those assets as liabilities on their balance sheets.

Let me translate:

Imagine you park a beat-up, rusty car in front of a fancy mansion. The mansion itself hasn’t changed—it’s still luxurious—but everyone thinks it’s worth less because of the ugly car parked outside.

That’s basically what SAB 121 does to banks holding crypto.

This rule made US banks steer clear of crypto like it’s broccoli at a kid’s birthday party.

Why?

Because their balance sheets would look weaker than my Wi-Fi signal during a storm.

Good News: SAB 121 Is (Hopefully) Outta Here!

President-in-waiting Donald Trump has promised to repeal SAB 121 on day one of his presidency.

Yep, the same guy behind the $TRUMP memecoin drama might end up being crypto’s unexpected hero.

What does this mean?

If SAB 121 gets the boot, US banks could start holding crypto without looking like they’re about to go bankrupt.

Translation:

Big financial institutions might finally roll out the welcome mat for crypto.

Your bank could soon be offering Bitcoin custody services, no shady offshore exchanges required.

Or, as I like to say: Hell (and I cannot stress this enough) yeah!

Why This Matters to You

If US financial institutions jump into crypto:

1/ More legitimacy for the entire market.

2/ Easier access for regular people to buy, sell, and hold crypto safely.

3/ A potential price boost for Bitcoin and other major assets as adoption grows.

So, whether you’re a seasoned hodler or someone who just found out “crypto” isn’t a breakfast cereal, this is big news.

That’s a wrap, folks! 🎤

I know I was requested to talk about AI’s and AI agents, but let’s be honest—this post was already stretching longer than a grandma’s goodbye. Maybe next Monday, sorry Sunday.

Speaking of life, it’s been chef’s kiss lately (minus the school part—let’s keep that real). I’ve been dialing down the crypto notes, shifting gears to focus more on the agency and personal brand. Don’t worry, I’m not ghosting crypto entirely—I’ll always be lurking in the blockchain shadows. But the bucket framework really helped me realize where to put my energy (and what actually moves the money needle ).

Now I’ll focus on the things that’ll move the (money) needle. II’ll still keep dropping my notes here for you to soak in, steal (ethically), and maybe even implement. And, of course, I’ll keep it real—open and honest—about the ups, downs, and sideways twists of this journey.

For now, that’s all I’ve got. See ya Wednesday!

Naaaah, this post took tooooo long to be written 😭🫠🥱

Reply