- Let's learn the path to financial freedom

- Posts

- From Gold Coins to the Digital Age: The Evolution of Investing and Why It Matters Today

From Gold Coins to the Digital Age: The Evolution of Investing and Why It Matters Today

Everything you need to know!

🚀 MARKET MOVERS 🚀

New Highs Alert: Tesla ($TSLA) reaches a record $436.23, gaining over 210% since April!

Inflation Update: November's inflation hits 2.7%, with the Fed keeping a close watch.

Tech Wins: Alphabet unveils its latest quantum project, sending shares up and jaws dropping.

Goood morning, and welcome back to ToTheUnknown—the weekly newsletter that's more rewarding than date night (and costs way less).

Today, I’ll cover the following:

🥇 From Gold Coins to the Digital Age

💰 Investing Through the Ages

If you think investing started when Bitcoin popped up in 2008—think again. Investing's roots go way back. Like... wayback.

Let’s set our time machine to the 1600s when European adventurers—mainly the Brits, Dutch (not “Duchess,” sorry autocorrect), and French—embarked on risky voyages to the East Indies.

Their goal?

To snag spices, silk, and other goodies. But ships weren’t cheap, and the risks? Think stormy seas, pirates, and getting lost because GPS didn’t exist.

This is where the first investors came in. They pitched in money to fund these trips, and if the voyage succeeded, everyone shared the loot. If not, well... there’s always next time. To avoid betting all their gold coins on a single ship, smart investors spread their money across multiple expeditions (shortly sayd, they Diversified).

Smart move, right?

📜 Pensions... Ancient Edition

Before we fast-forward to Wall Street, let’s detour to Roman times. Augustus Caesar (yes, that Caesar) had the bright idea to create a pension plan for retired soldiers.

Why?

To keep them happy and not, you know, overthrow him. That’s elite level problem-solving.

⚖️ The Birth of Stock Trading

Now, onto the real juicy stuff. Trading stocks wasn’t always as flashy as Wall Street bell rings or Tesla memes. Back in the day, people traded shares over coffee (yes, actual coffee houses).

Okei, now a little trivia, to see, how smart you really are

🤓 The first official stock exchange was created in…?

A) Florence, 1611

B) Amsterdam, 1602

C) London, 1653

D) Antwerp, 1595

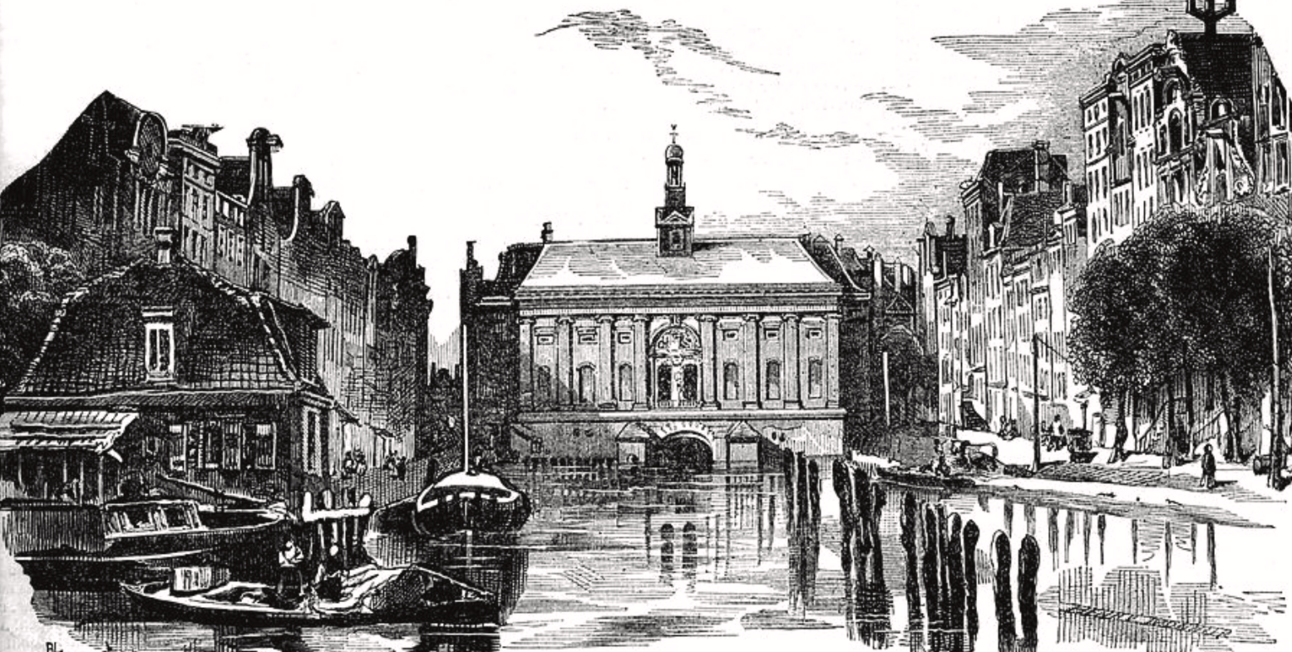

This may give you a hint*

🎉 If you guessed B) Amsterdam, 1602, you got it!!

They paved the way for today's trillion-dollar markets. By 1801, the London Stock Exchange followed, kicking off in a coffee house (again with the coffee).

Can we agree coffee fueled capitalism? ☕

Fast forward to the 21st century, and the game’s been completely flipped. Forget waiting weeks for trade confirmations. Thanks to high-frequency trading, transactions happen in less than a millionth of a second. (Faster than you can say, “I should’ve bought Tesla.”). A millionth of a second—so fast, it makes your Wi-Fi speed feel ancient.

If that blows your mind, welcome to modern investing.

And that’s just the beginning.

From ancient Rome to the East India Company to today’s quantum-speed trades, investing has always been about taking calculated risks, adapting to new tools, and—most importantly—understanding the game.

🤔 Why Does It Matter To Invest?

Let’s be brutally honest: Your money is shrinking. In fact, it’s being eaten alive by inflation like a hungry bear devouring a picnic basket. (I’m sorry, the meme didn’t load)

You’ve probably heard this before, but it’s the reality—saving your money isn’t enough. If you’re keeping it in the bank under your mattress or in some low-interest account, congratulations, you’re basically losing money in plain sight. (Not the greatest strategy for becoming a millionaire, right?)

Let me break it down: I started investing when I was 12.

Yes, 12.

Don't act surprised—I had my sights on the future from an early age. 🤓 Fast forward a few years, and my investments have more than doubled. And I didn’t do anything crazy—just some smart decisions, and now I’ve got the most powerful tool in the world working for me: Compound Interest.

What’s the magic here?

Compound interest is like your money working while you nap.

Seriously, you don’t even have to lift a finger—your money just gets bigger and bigger while you focus on the important stuff, like grabbing the next pizza. And the younger you start, the more you can stack over time.

Here’s why investing matters now more than ever:

Social Security benefits won’t be enough to keep you rolling in the dough when you retire. You need your own stash to live off of without begging for discounts at the grocery store.

So, instead of crying over your future, start building it. Because with the right investments, you can live off the money in your accounts, no more wondering if you’ll make it to payday.

In short: Don’t sit around waiting for the perfect moment—start investing NOW. Your future self will send you a thank-you card.

🤑 Inflation Hits 2.7% in November: What It Means for Your Wallet

Alright, so here's the scoop on inflation: Inflation in November 2024 hit 2.7%. That’s a little bump up from the 2.4% in October.

Now, you might be wondering, "What does that mean for me?"

Well, it’s simple:

Prices are still rising, but they’re not going through the roof like they were before. The Federal Reserve (aka the "money boss" of the U.S.) is trying to get inflation down to about 2%, but they’re not ready to cut interest rates just yet. They want to make sure the economy can keep things in check before making any big moves.

But here’s the silver lining: Rent prices, which have been driving inflation through the roof, are finally slowing down. This is a big deal because it means fewer crazy increases in rent and housing costs.

So, if you’ve been struggling with your rent or apartment costs, there’s a bit of good news ahead!

What does this all mean for your wallet?

Well, it means prices could start to feel a little more manageable soon. But the Fed isn’t going to do anything drastic until inflation comes down to their target, which might take a bit longer.

So for now, it’s all about waiting and watching how things play out.

Stay tuned for what happens in December, and I’ll do my best to keep you guys (and girls) updated!

😲 Alphabet unveils its latest quantum project, sending shares up and jaws dropping

folks, here's the latest news that'll make you feel like you're living in the future: Alphabet (you know, Google’s parent company) just unveiled its latest quantum computing project, AlphaQubit…

Wait, Wait, Wait…

First things first: What the heck is quantum computing? If you're not so smart (me included) and don’t know what it is, here’s the simple breakdown:

Traditional computers use bits, which are like little light switches—either on (1) or off (0). But quantum computers use qubits, which can exist in multiple states at once, thanks to a strange and fascinating thing called superposition. Imagine trying to solve a maze. A regular computer would try every path one at a time, but a quantum computer can explore all the paths at the same time. This means quantum computers can solve problems much faster than regular computers, especially when it comes to complex tasks like simulating molecules or solving intricate mathematical problems.

Now, let’s talk about why Alphabet’s announcement is such a big deal. The tech giant just unveiled its latest quantum project, AlphaQubit, which promises to reduce errors in quantum systems by 30%. If they pull this off, it could lead to quantum computers that are way more powerful and reliable than what we have now.

Here’s the fun part: this breakthrough could completely change the game. We're talking about everything from making new medical discoveries to solving climate change and strengthening cybersecurity. But before you start imagining flying cars powered by quantum tech, remember: this is still very early-stage stuff. We’re not going to have quantum computers running our lives just yet.

That being said, I hope you found this breakdown useful and maybe learned a thing or two along the way.

Good luck with everything you're working on, and I’m off to start writing the next post.

Catch you later!

Reply